"Life is precious, but the price of love is higher …" Recently, the record of divorce case with sky-high A shares was refreshed again.

On the evening of May 29th, Kangtai Bio (300601), a listed company on the Growth Enterprise Market, released the changes in equity Report, in which Du Weimin, the controlling shareholder and actual controller of the company, intends to split and transfer 161 million shares of the company (accounting for 23.99% of the company’s total share capital) to Yuan Liping.

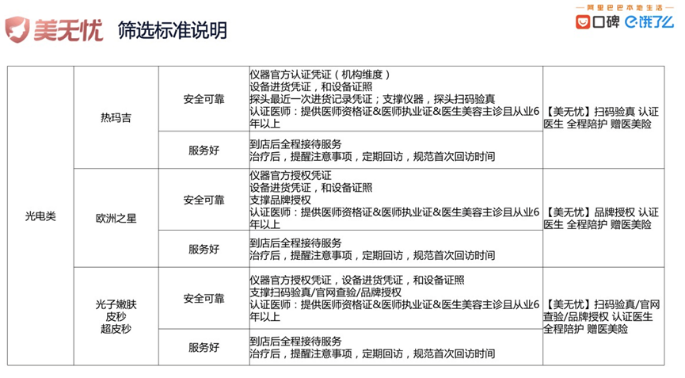

Image source: Kangtai Biological Announcement

According to the closing price of Kangtai Bio on May 29, 146 yuan/share, the market value of Du Weimin’s split shares reached 23.5 billion yuan, setting a record for the highest divorce case in A-share history. Prior to this, the highest record in the A-share market was 7.5 billion yuan, which was created by the divorce of Zhou Yahui, chairman of Kunlun Wanwei.

Behind this eye-catching sky-high divorce case is Du Weimin’s controversial family history and Kangtai Bio’s capital operation, which has also been brought back into people’s attention. Since then, a controversial story has begun.

Being questioned by investors is a "technical divorce"

According to public information, Kangtai Bio is an enterprise integrating R&D, production and sales of biological products. It was established in September 1992 with a registered capital of 369 million yuan. It is headquartered in Shenzhen and listed on the Growth Enterprise Market of Shenzhen Stock Exchange on February 7, 2017.

The company started with vaccines, and its main products include recombinant hepatitis B vaccine (Saccharomyces cerevisiae), Haemophilus influenzae type B conjugate vaccine, measles and rubella combined attenuated live vaccine, acellular pertussis combined vaccine of Haemophilus influenzae type B, and 23-valent pneumococcal polysaccharide vaccine. Among many products, Kangtai Bio is best known for hepatitis B vaccine.

Since 2020, Kangtai Bio’s share price has been strong, hitting record highs, with a total market value approaching 100 billion. The company’s performance has also continued to grow. From 2017 to 2019, its total operating income was 1.161 billion yuan, 2.017 billion yuan and 1.943 billion yuan, respectively, and its net profit returned to its mother was 215 million yuan, 436 million yuan and 575 million yuan. The company’s growth rate has maintained a high growth rate of more than 31% for six consecutive years.

Image source: Kangtai Bio 2019 Annual Report

It is worth noting that although Kangtai Bio’s total revenue in 2019 was 1.94 billion yuan, its gross profit was 1.77 billion yuan, with a gross profit margin of 91.24%. The net profit is 575 million yuan, and the net profit rate is as high as 29.64%, which shows that the vaccine industry is profiteering.

Of course, due to the sustained high growth of Kangtai Bio, the market has continued to give it a high valuation. The share price of 146 yuan, compared with Kangtai Bio’s earnings per share of 0.91 yuan in 2019, has a P/E ratio of 160 times and a P/B ratio of 33.8 times.

Image source: Kangtai Bio 2019 Annual Report

In addition to the hot speculation on pharmaceutical bio-stocks in recent years, the COVID-19 epidemic is obviously an important factor contributing to the stock price of Kangtai Bio. In February, 2020, Kangtai Bio announced that it had cooperated with Eddie Weixin (Suzhou) Biopharmaceutical Co., Ltd. to develop novel coronavirus DNA vaccine. In the following three months, Kangtai Bio’s share price rose by nearly 50%.

In this sky-high divorce case, Du Weimin’s ex-wife Yuan Liping simply wanted shares and did not seek actual control of the company. According to the announcement of Kangtai Bio, in order to keep the normal operation of Kangtai Bio unaffected and continue to maintain Du Weimin’s actual control over Kangtai Bio, Du Wei and Yuan Liping signed the Agreement on Entrustment of Concerted Action and Voting Rights. The agreement stipulates that Yuan Liping agrees to entrust Du Weimin with the shareholder rights of the shares he holds, and the two establish a concerted action relationship.

It is worth noting that the behavior of shareholders of listed companies to split their shares through divorce and then reduce their holdings has always been concerned by all parties in the market. Coupled with the time of this divorce, it coincides with the historical high of Kangtai Bio’s share price. Therefore, Du Weimin was also questioned by investors as a "technical divorce" and was suspected of circumventing regulatory restrictions to reduce his holdings. In this regard, the health sector called Kangtai Bio to inquire about the company’s response, and no reply has been received as of press time.

Kangtai Bio also disclosed in the "Simplified Statement of Changes in Equity" that the information disclosure obligor does not rule out the possibility of increasing or decreasing its shares in listed companies in the next 12 months.

A vaccine salesman’s "perfect counterattack"

Du Weimin’s family history can be described as "legend", from the inspector of epidemic prevention station who came out of poor mountain families in Jiangxi to the upstart in the field of hepatitis B vaccine in China.

In 1963, Du Weimin was born in the rural area of Jinggangshan, Jiangxi Province, and was assigned to Jiangxi Provincial Health and Epidemic Prevention Station after graduation. At the beginning of the reform and opening up in the 1990s, Du Weimin resigned and went to sea to become a vaccine marketing salesman. Won the first bucket of gold in life in Changsheng Bio (a wholly-owned subsidiary of Changchun Changsheng).

In March 2001, Du Weimin founded the company with his colleague Han Gangjun. In September of that year, Changsheng Bio-Institute transferred 0.68% equity of Changsheng Industry to Guangzhou Mengyuan, which Du Weimin held, at a consideration of 437,900 yuan. Since then, Du Weimin has indirectly become a shareholder of Changsheng Bio.

In June 2003, Du Weimin began to serve as the director and vice chairman of Jiangsu Yanshen Bio. However, in 2009, the rabies vaccine produced in Yanshen, Jiangsu Province was ordered by National Medical Products Administration to stop production for rectification because of counterfeiting. Du Weimin resigned from Jiangsu Yanshen and cashed in his shares.

During this period, Du Weimin began a five-year study tour. According to media reports, he went to European and American vaccine giants and many biotechnology research institutions to study and inspect, but remotely controlled domestic affairs. In 2007, the Du Wei mutiny sold its Canadian property and returned to China with his wife and children, rejoining the vaccine industry.

In 2008, Du Weimin became the controlling shareholder of Shenzhen Kangtai Biological Products Co., Ltd., the largest hepatitis B vaccine manufacturer in China, through strategic restructuring.

After a series of dazzling moves, Du Weimin, his wife and other shareholders spent 100 million yuan to set up Minhai Bio. A few months later, they were valued at 240 million yuan to enter Kangtai Bio through restructuring, and then they took over all the shares of five shareholders with state-owned backgrounds at low prices. Although it is difficult to accurately calculate the specific data, some media estimate that it only costs about 368 million yuan to fully control Kangtai Bio.

Since then, Du Weimin has sold some shares to institutions and natural persons at high prices. While the husband and wife earned a net profit of 163.2578 million yuan, they also controlled 62.16% of the shares of Kangtai Bio when they went public in 2017.

In December 2013, Kangtai Bio and Du Weimin ushered in the biggest crisis.

Eight newborns died within 10 days after being inoculated with recombinant hepatitis B vaccine (Saccharomyces cerevisiae) produced by Kangtai Bio, and china food and drug administration urgently suspended the use of all batches of recombinant hepatitis B vaccine (Saccharomyces cerevisiae) produced by Kangtai Bio.

However, the investigation results in January 2014 showed that the incident was a coincidence, and china food and drug administration decided to resume the use of Kangtai bio-related vaccine, and Du Weimin escaped unscathed in the vaccine storm.

In 2017, the Beijing High Court ruled in the second instance that Yin Hongzhang, deputy director of china food and drug administration Drug Evaluation Center, had paid bribes to Yin Hongzhang. But this did not affect Kangtai Bio’s peak.

In February 2017, Kangtai Bio was successfully listed on the Growth Enterprise Market, with a market value of 1.392 billion according to the issue price. A year later, the market value of Kangtai Bio soared to more than 30 billion, and Du Weimin’s personal wealth also changed from 755 million to 20 billion.

In 2018, the event of longevity biological vaccine broke out, and Kangtai Bio’s share price quickly came out of the haze only after being affected for a short time. Then the share price climbed, and Du Weimin also went to the highlight moment of life. In October 2019, Du Weimin won 130 places on the Hurun Rich List with a wealth of 24.5 billion yuan. In February 2020, Du Weimin ranked 524th on the Hurun Global Rich List with a wealth of 33 billion yuan.

Those expensive "breakup fees"

In recent years, the expensive divorce fee of A-shares has appeared frequently, and many media have also publicly reported it.

In addition to the record breaking fee of 23.5 billion yuan and the record breaking fee of over 7.5 billion yuan by Zhou Yahui, chairman of Kunlun Wanwei in September 2016, there are many cases of breaking fee of over 100 million yuan by bosses or executives of listed companies.

In October 2013, Wang Ning, the chairman of Shenzhou Taiyue, divided his 120 million shares into the name of his ex-wife An Mei due to divorce, and the equity value was as high as 1.23 billion yuan.

On January 28th, 2016, the Electric Power Research Institute announced that Hu Chun, the actual controller, planned to transfer 32 million shares (accounting for 4.44% of the total share capital) to Wang Ping for free, on the grounds that the divorce property was divided, and the breakup fee was worth 356 million yuan at that time.

On January 4, 2017, Yinxintang announced that Ruan Hongxian and Liu Qiong, the controlling shareholders, had gone through divorce procedures. After the share split, the market value of their shares was 3.7 billion yuan and 2 billion yuan respectively.

In January 2017, Meng Jie Chairman Jiang Tianwu and his wife Wu Jing signed the Divorce Agreement, and transferred 127 million shares to Wu Jing’s name, with a market value of about 1 billion yuan.

In December 2018, Zheng Dali, a shareholder of Baby Friendly Room, divided 3.9 million shares to Yang Qingfen due to marriage, accounting for 3.9% of the company’s total share capital. According to the latest price of the day, the market value is close to 168 million yuan.

In September 2019, Zhou Heping, the largest shareholder of Wal-Mart Nuclear Materials, transferred his 182 million shares to his ex-wife regarding the division of divorce property. According to the market value at that time, it was equivalent to a "breakup fee" of about 900 million yuan.

In January 2020, Shen Xiaoyu, the post-80s actual controller of Tony Electronics, transferred his 12,901,500 shares to his ex-wife and paid a "breakup fee" worth more than 300 million yuan.

In February 2020, Xu Jiadong and Li Junqiu, 15.22% shareholders of Cross-border Link, went through the formalities of dissolving the marriage relationship, and Xu Jiadong divided 70.11 million shares (accounting for 4.50% of the company’s total shares) to Li Junqiu, with a market value of 460 million yuan at that time.

(This article is compiled from China News Network, Yangcheng Evening News, Delinshe, Zhongxin Jingwei, 21st century business herald, Thumb Medicine, and company announcements)