Bright window models are selling like crazy, accounting for as much as 43%! Analysis of VAN Series Vehicle Sales in August

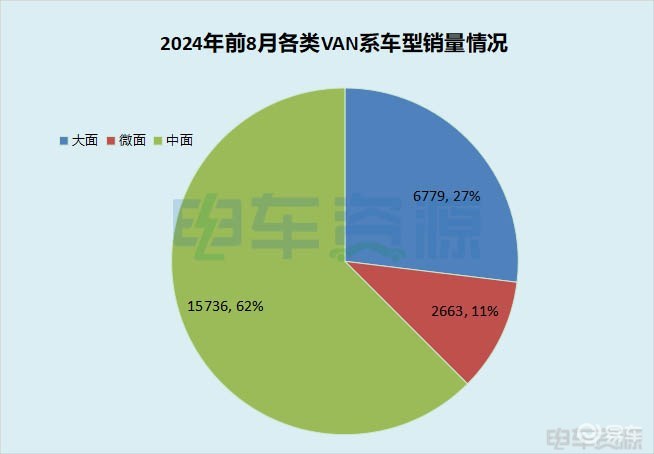

Overall market:In August, the overall sales volume of the VAN Department exceeded 25,000 vehicles, of which the mid-plane accounted for nearly 60% of the sales volume, with the largest growth rate. In the first eight months, the overall sales volume of VAN has completed 93% of last year’s sales volume, exceeding 160,000 vehicles.

Market structure:In August, the sales of SAIC-GM-Wuling, Long-range New Energy Commercial Vehicle and Changan Kaicheng VAN series vehicles were in the top three; From January to August, the sales volume of SAIC-GM-Wuling exceeded 29,000, and the sales volume of long-range new energy commercial vehicle VAN series exceeded 27,000.

Vehicle pattern:In August, the sales volume of, series was in the top two, accounting for 27.58% and 14.55% respectively. From January to August, Wuling Yangguang and Remote Star Enjoy V series both exceeded 23,000 vehicles, Ruichi EC75 exceeded 14,000 vehicles, and Kairui series exceeded 10,000 vehicles.

Market highlightsSince the beginning of this year, the sales of bright window models have been bright, and the market share has increased from 14% in January to 43% in August, which is crazy in the market!

Regional distribution:In August, the sales volume of VAN cars in Shenzhen was 2,443, and that in Guangzhou was 1,391. From January to August, the number of VAN vehicles in Shenzhen exceeded 19,000, that in Guangzhou exceeded 10,000, and that in Dongguan and Foshan exceeded 5,000.

VAN department’s overall market showed positive growth, with a year-on-year growth for six consecutive months.

Looking back this year, except for the year-on-year decline in February due to the influence of the Spring Festival holiday, the sales volume of VAN Department increased in different degrees year-on-year, and the year-on-year growth rate in August reached 34.48%, which was much higher than that of the card department in the same period.

However, it is worth noting that the year-on-year growth rate of the VAN Department has gradually narrowed since May. Tram resources believe that the reason is mainly related to the growth bottleneck encountered by VAN market segments.The penetration rate of new energy in the middle market, which occupies the largest share of the VAN market, has almost reached the ceiling.In recent months, the average permeability is 95%, and the market tends to be saturated, and the growth rate is weak, while the growth rate of micro and large areas is not strong, so it is difficult to offset this gap, which leads to such a situation.

Open-window models account for 43% in August, which may cause great changes in the pattern in the future.

Judging from this year’s data, the Ming-window models are really selling like crazy, and their sales volume has been rising continuously from May to August, even more so than the blind-window models, and the market share has increased from 14% in January to 43% in August. Ming-window models have sprung up in the market by virtue of their insurance advantages and the ability to stand on the shelf, which also makes the models with Ming-window versions more dominant, and relatively speaking, the sales increase is more obvious!

Judging from the specific models, in the VAN market in August, only five models, namely Wuling Yangguang, Remote Star V Series, Ruichi EC75, Kairui finless porpoise series and Chang ‘an, sold more than 1,000 vehicles. From the data point of view, the models with bright windows played a great role in their sales.

Among them:

In the sales volume of Wuling Yangguang, the bright window model accounts for 73.51%. It is worth mentioning that Wuling Yangguang has won the first place in the monthly sales volume of VAN series cars for five consecutive months this year.

In the sales volume of remote Star V series, the bright window model accounts for 45.39%;

In the sales volume of Chang ‘an Ruixing EM80, the bright window model accounts for 75.54%.

However, Ruichi EC75 and Kairui finless porpoise series are relatively disadvantaged in the competition because there is no open window version. However, according to the tram resources,Kairui finless porpoise series will be released soon.In the latest 387 new car announcements, Changan Kaicheng declared.Chang’ an ruixing EM60II’s open-window passenger version. In addition, according to industry sources,Liuzhou wuling New Energy will also release the bright window model soon..

Tram Resources predicts that the VAN market structure will change greatly next year: from January to August this year, the sales volume of SAIC-GM-Wuling exceeded 29,000 units, of which bright windows accounted for 46.58%, and the sales volume of long-range new energy commercial vehicles exceeded 27,000 units, with bright windows accounting for 20%. With the release of open-window models of other enterprises, the competition pattern of models should change greatly.

At present, the pattern of vehicle models is stable, but there may be great changes in the future.

In August, the VAN market was still dominated by the middle market, followed by the big and micro markets. According to the data of the previous August, the sales volume of medium-sized noodles has exceeded 97,000, that of large-sized noodles has exceeded 44,000, and that of micro-sized noodles has exceeded 23,000.

Specific to August:

In AugustZhongmian marketAmong them, SAIC-GM-Wuling, Remote New Energy Commercial Vehicle and Changan Kaicheng ranked in the top three, followed by Wuling Yangguang, Remote Star Enjoy V6E and Changan Ruixing EM80, with sales of 6,943, 3,091 and 1,304 respectively.

In AugustDamian marketAmong them, Ruichi Automobile, Long-range New Energy Commercial Vehicle and SAIC Chase ranked in the top three, followed by Ruichi EC75 and SAIC Chase, with sales of 1,717, 754 and 647 respectively.

In AugustMicroface marketAmong them, Changan Kaicheng, Xinyuan Automobile and Kairui New Energy ranked in the top three, followed by Changan, Xinyuan X30L EV and Kairui, with sales of 566, 557 and 339 respectively.

On the whole, the competition pattern of VAN market is relatively stable, which is mainly based on the middle surface, supplemented by the large surface and micro surface. However, in the VAN market, the middle surface has the highest permeability, followed by the large surface and then the micro surface, which shows that the pattern of the VAN market should change greatly in the future.

Does the big face have great potential in Shenzhen?

According to the data in August, the year-on-year growth rate of the large area is the largest, but it is still dominated by the middle area in the cities with sales volume of TOP5.Among them, only Shenzhen market occupies a dominant position. In August of this year, VAN models were mainly sold to Shenzhen, Guangzhou, Dongguan, Wuhan and Suzhou, among which the model with bright windows only accounted for 5.85% in Shenzhen market, while other cities had a high share. For example, the share of bright windows in Guangzhou is as high as 57.8%, the share of bright windows in Wuhan is also 55.95%, and the share of bright windows in Suzhou is close to 70%.

Tram resources believe that this is mainly due to the small proportion of open-window models in Shenzhen, while other areas mainly focus on open windows, and open windows are mainly in the middle. In view of this situation, Tram resources believe that this is actually beneficial to the Shenzhen market. Because the best-selling of Ming-window models is more of a "shortcut", the risks behind it can be imagined. If the time line is lengthened, the development of the open window model will inevitably have a further impact on insurance, and this model is likely to be rejected by insurance companies first.

Conclusion:Easy access to insurance and low premium are the key driving factors for the outbreak of Ming-window models. However, tram resources also remind all vehicle operators to strengthen the training of drivers’ awareness of safe driving, do a good job in monitoring the safe operation of vehicles, and prevent and control the occurrence of high accident rate from the root.